Negative news headlines regarding economic conditions can be unsettling and it’s natural to question the impact these events may have on your super and your retirement. While in some cases it may be appropriate to switch options, it could be sensible to stay invested in a diversified portfolio to try and avoid unstable markets. Volatile market conditions can have its share of ups and downs, so it’s wise to look at super as a long-term investment.

Changing market conditions

During volatile market conditions, it’s possible to consider switching from a diversified investment option, such as AustralianSuper’s Balanced option, to a cash option. Although the cash option is a way to avoid market fluctuations and downward market trends, members could also miss out on the growth phase of market cycles when markets bounce back1.

Looking past short-term volatility

Looking past market turbulence in the short-term can be challenging. But history shows that markets increase in value over the long term. Members who stay invested in diversified portfolios could end up in a better position in the long term, compared to those who switch investment options. It may be appropriate to seek financial advice to determine what is right course of action for you.

Investing for the long term – AustralianSuper’s investment approach

AustralianSuper has an in-house team of over 280 investment professionals2 who continually assess economic and investment data to determine the fund’s investment strategies.

By investing in a mix of assets, the team aims to reduce risk, maximise investment opportunities and grow members’ retirement savings over the long term.

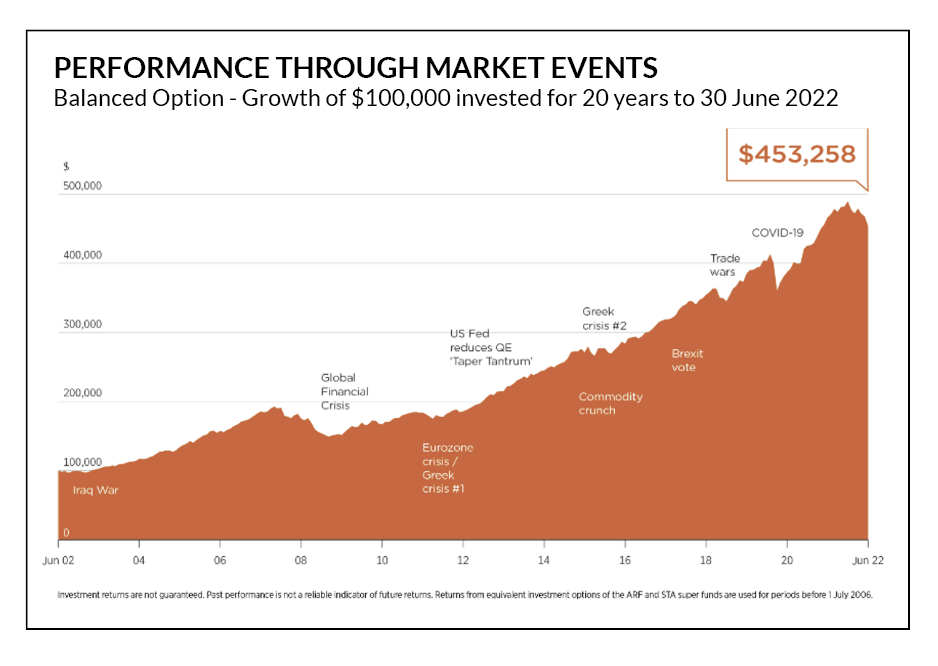

The graph below shows the performance of AustralianSuper’s Balanced option over 20 years through market fluctuations, from 30 June 2002 to 30 June 2022. It uses a starting balance of $100,000 and shows how – over 20 years – that balance has grown to $453,258.

Considering switching investment options?

It’s important to focus on your long-term retirement goals and if you’re considering making a change to your super options or seeking advice, talk to a financial adviser. They can help you make the right investment choices for your personal goals and risk appetite. A financial adviser can also guide you when investment markets are bumpy, providing reassurance. This could help you stay focused on the long-term and ease any worries you may have.

- Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

- As at July 2022.

AustralianSuper investment returns are based on crediting rates, which are returns less investment fees, the percentage-based administration fee and taxes. Returns don’t include all administration, insurance and other fees and costs that are deducted from account balances. Returns from equivalent investment options of the ARF and STA super funds are used for periods before 1 July 2006. Investment returns aren’t guaranteed. Past performance isn’t a reliable indicator of future returns.

Personal financial product advice is provided under the Australian Financial Services Licence held by a third party and not by AustralianSuper Pty Ltd. Some personal advice may attract a fee, which would be outlined before any work is completed and is subject to your agreement. With your approval, the fee for advice relating to your AustralianSuper account may be deducted from your AustralianSuper account subject to eligibility criteria.

This may include general financial advice which doesn’t take into account your personal objectives, financial situation or needs. Before making a decision consider if the information is right for you and read the relevant Product Disclosure Statement, available at australiansuper.com/pds or by calling 1300 300 273. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the TMDs at australiansuper.com/TMD.

Sponsored by AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898.

This article was supplied as part of a paid advertising package.