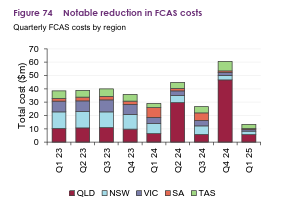

In recent years, Frequency Control Ancillary Services (FCAS) have provided a lucrative revenue stream for many industrial and commercial energy users. FCAS are essential services that help maintain the stability and reliability of the grid by managing frequency variations. However, recent FCAS prices have seen a significant decline.

In its latest white paper, Understanding the decline in FCAS prices, energy technology company and ASI Associate Member GridBeyond explores the reasons why FCAS prices have fallen and what businesses can do to recoup lost revenues.

Declining FCAS

According to the latest Quarterly Energy Dynamics report (covering Q1 2025), published by AEMO, total FCAS costs reached $13 million in Q1 2025, representing approximately 0.3% of the total cost of consumed energy* for the quarter. This marks a $16 million decrease compared to the same period last year. This reduction was mainly driven by lower FCAS prices and a smaller number of volatility events during the quarter, relative to last year.

In the same time period, Battery Energy Storage System (BESS) output increased by 86% year-on-year in the National Electricity Market (NEM), reaching an average of 98MW. The significant decline in FCAS prices reflects the impact of increased battery storage capacity and evolving market dynamics. Although FCAS prices are decreasing, energy prices will stay high providing an opportunity for businesses to recoup lost revenues, with the right technology.

While falling FCAS prices present a challenge, they also mark a shift in how value is created. The key for industrial and commercial businesses is to shift from passive participation in legacy markets to proactively stacking value through energy flexibility. Businesses that embrace this change can recoup lost value and capture even greater returns in the long run.

Demand side response and process optimisation

Against the FCAS revenues decline, demand side response and process optimisation can allow metal companies and other type of industries to identify real flexibility opportunities, enable more informed decision-making in optimising energy and creating a more efficient and cost-effective energy strategy.

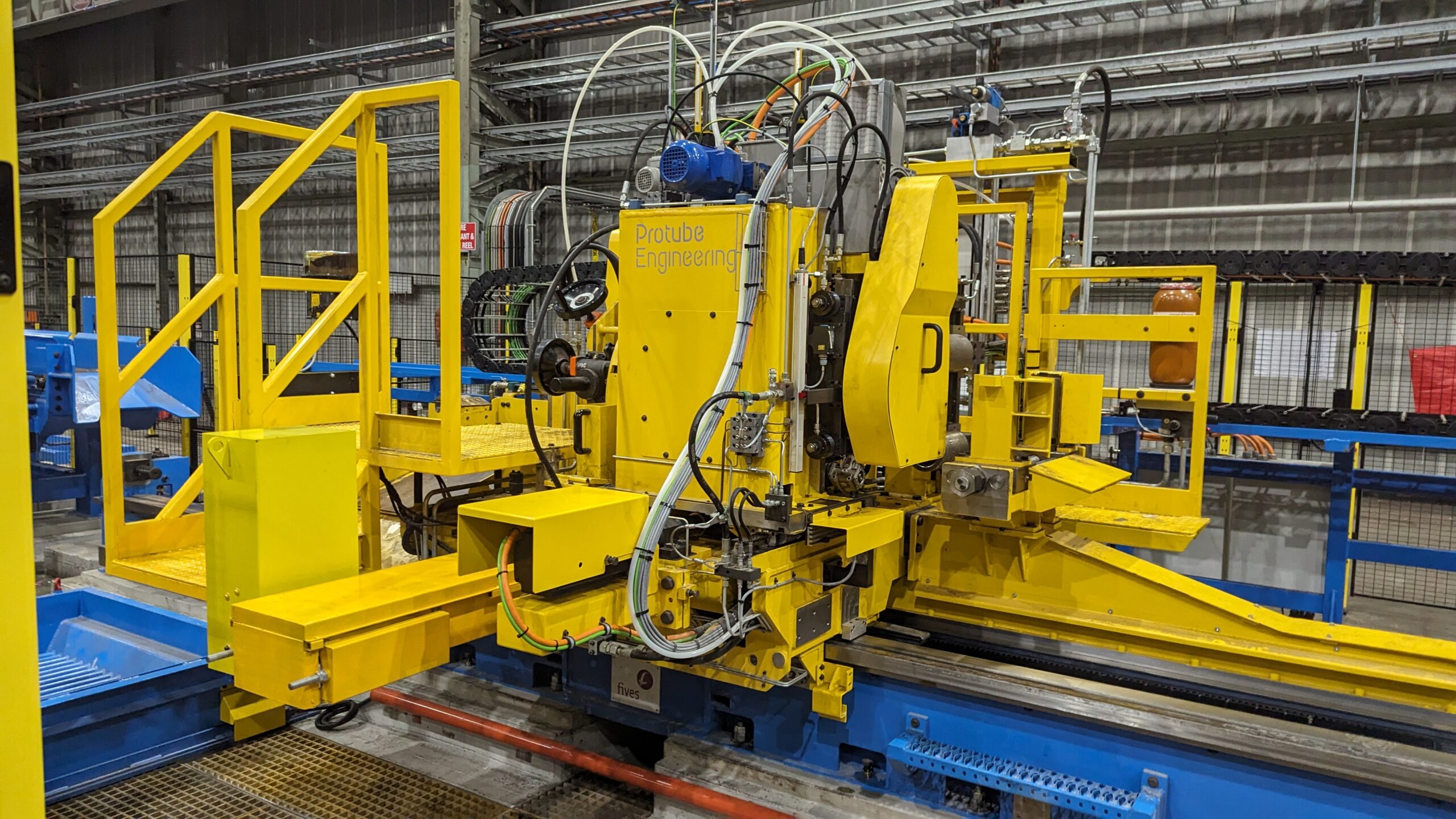

Using advanced solver-based optimisation and digital twins GridBeyond’s Process Optimizer helps unlock maximum flexibility without impacting production. GridBeyond’s platform employs AI and machine learning, ensuring that hard constraints such as site load and downtime periods are met while optimising against energy costs, asset load, and any on-site generation or storage technologies.

Process Optimizer provides a unique opportunity for industrial sites and can boost profitability by aligning businesses production with variable energy prices while guaranteeing production targets.

These data-driven services use digital simulations of each industrial process to identify efficiencies in plant schedules, optimising each sub-process against variable energy market prices while ensuring that overall daily and weekly production targets are met.

To download a copy of the white paper, visit: https://gridbeyond.com/lp/au-whitepaper-understanding-the-decline-in-fcas-prices/

About GridBeyond

GridBeyond is a global market leader in battery management and energy trading solutions for industrial, commercial, institutional, and utility partners.

GridBeyond is a smart energy company led by Michael Phelan and Richard O’Loughlin. Since its commercial launch in 2010, the company has been revolutionising the energy sector through the use of technologies and business models that are advancing the transition to the next-generation electricity industry. GridBeyond is now a global leader in managing assets of all types at the grid edge.

GridBeyond envisions a future where they work hand in hand with customers to unearth the full potential of energy assets, crafting sustainability, resilience, and affordability to steer the course towards a zero-carbon future. Their technology unlocks the potential of every connected asset, from utility-scale renewable generation and battery storage to industrial loads.

By intelligently dispatching flexibility into the right market at the right time, asset owners and energy consumers can unlock new revenues and savings, enhance resilience, manage price volatility, and support the transition to a net zero future.

For further information, visit: https://gridbeyond.com/